Equities, news and

trading rules

Using machine-readable news from the Financial Times to trade US large-cap stocks

The sheer amount of news generated each day makes it difficult for a trader to read everything of relevance.

Can a computer therefore replicate the way a discretionary trader reads the Financial Times, to harvest alpha from the FT?

This research demonstrates how equity traders can use machine-readable FT news articles to create systematic trading strategies for large-cap US stocks.

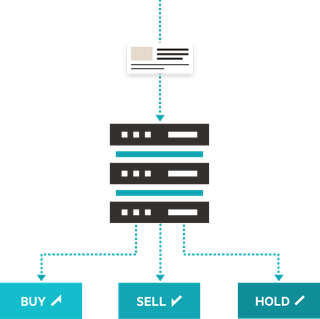

The idea of using machine-readable news to trigger trades is that you can mimic what a trader has traditionally done, in that a trader has historically extracted a signal from the news. The difficulty is that there is simply too much news for a human to read in practice. Using a computer to parse news, by contrast, allows many articles to be read very quickly to create a trading signal.

Founder of Cuemacro and author of this report

Backtesting systematic trading strategies using FT news

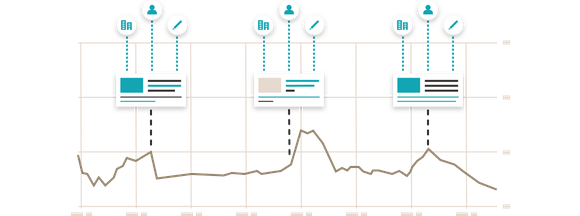

The report illustrates how news sentiment indicators could be used as inputs into systematic trading rules for US large-cap stocks. In theory, an equities specialist could add a news sentiment factor to their portfolio of existing factors and see how it improves their risk-adjusted returns overall.

The chart below presents the returns of a FT news sentiment portfolio using the best performing daily and intraday rules, against our S&P 500 benchmark. The report summarises and explains the different rules that were backtested in more detail.

Trading large-cap US stocks with FT news sentiment outperforms S&P 500

News sentiment indicators and price action

Once daily and intraday news sentiment indicators are constructed, the report discusses how they relate to price action.

We see in the majority of cases there is a positive correlation between the sentiment score and returns.

The report looks at the long-term correlation between daily news sentiment and the 2 week returns for all the stocks in our trading universe. In the majority of cases we see there is a positive correlation between the sentiment score and returns.

Long-term correlation between future 2 week returns and sentiment