By Saeed Amen, Founder of Cuemacro.

It is hardly groundbreaking to note that news moves markets! Traders have been reading publications such as the FT for generations. The key question is whether we can replicate how a trader consumes news to trade, to trade news in a systematic way. In other words, can we get a computer to read news and distill some market insights from it?

Digging into FT news data

Our recently published research focuses on use cases for macro investors for the FT's machine-readable news. Since 2017, FT Integrated Solutions has published the FT's news in a machine-readable form that is more easily consumed by a computer. Alongside the body text of each article there are also a number of tags which disclose, for example, the topic discussed in the article, as well as any people mentioned. For equity investors, articles are also tagged with FIGI tickers, where articles mention a public company.

Systematically trading S&P 500 futures with FT news

The research paper contains a number of stylised examples of sentiment indices and news counts generated from the FT's machine-readable dataset, and I'll present a selection of these in this post. It also presents a systematic trading rule for S&P 500 futures utilising FT news.

Essentially, we created a sentiment index off the back of FT news articles written about US equities. The trading rule was fairly intuitive. When sentiment in FT news on US equities was strong, it would stay long S&P 500 futures. Conversely, when it indicated poor sentiment, it would go short S&P 500 futures.

Below are the backtested results for trading our systematic FT/S&P 500 futures rule alongside a benchmark of long only S&P 500 futures. The risk adjusted returns of the active trading rule are 0.75, higher than the risk adjusted returns of the benchmark which are 0.63. The active trading rule also has considerably smaller drawdowns (-39.0%) versus the benchmark (-56.3%).

Stylised examples using FT news

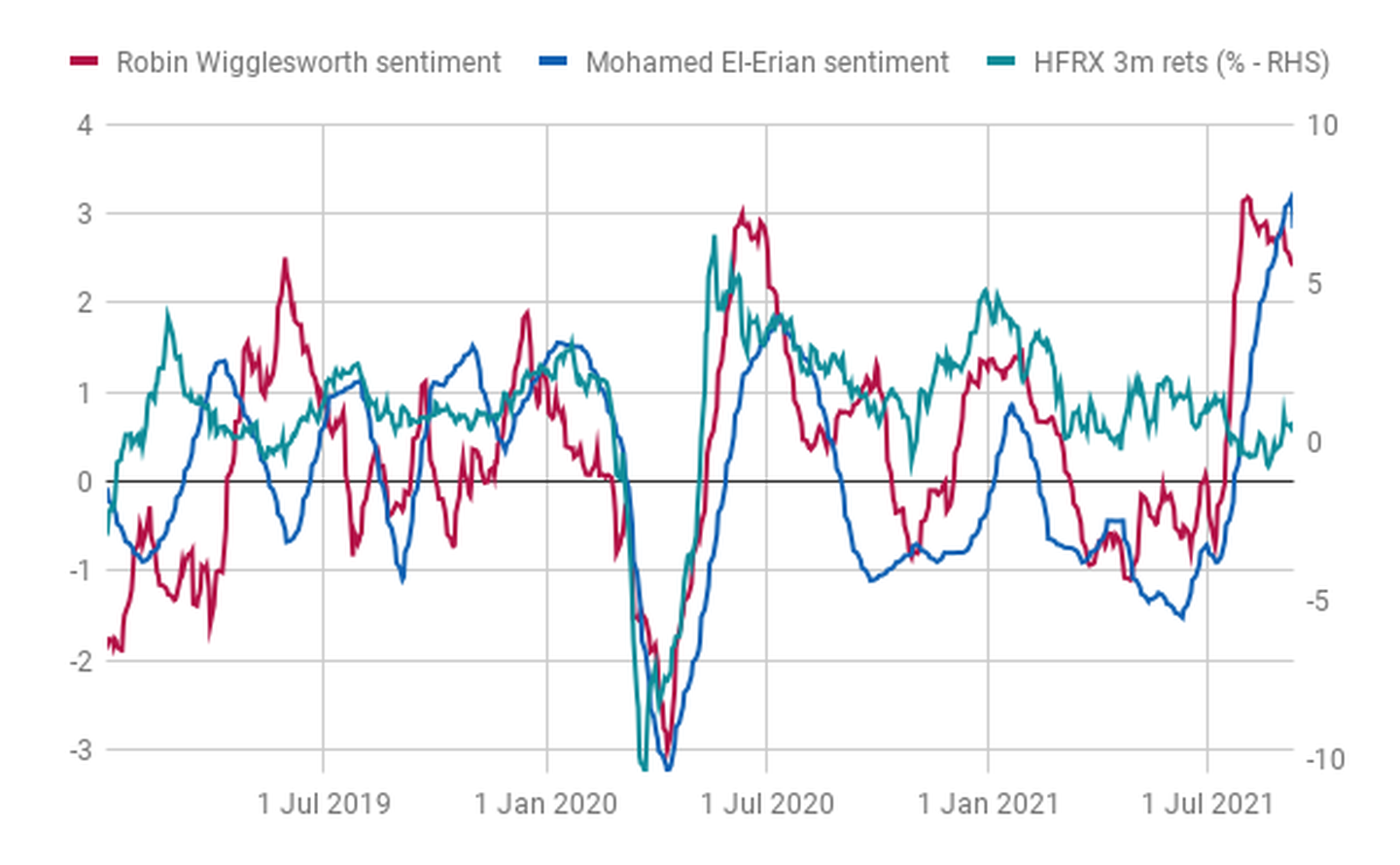

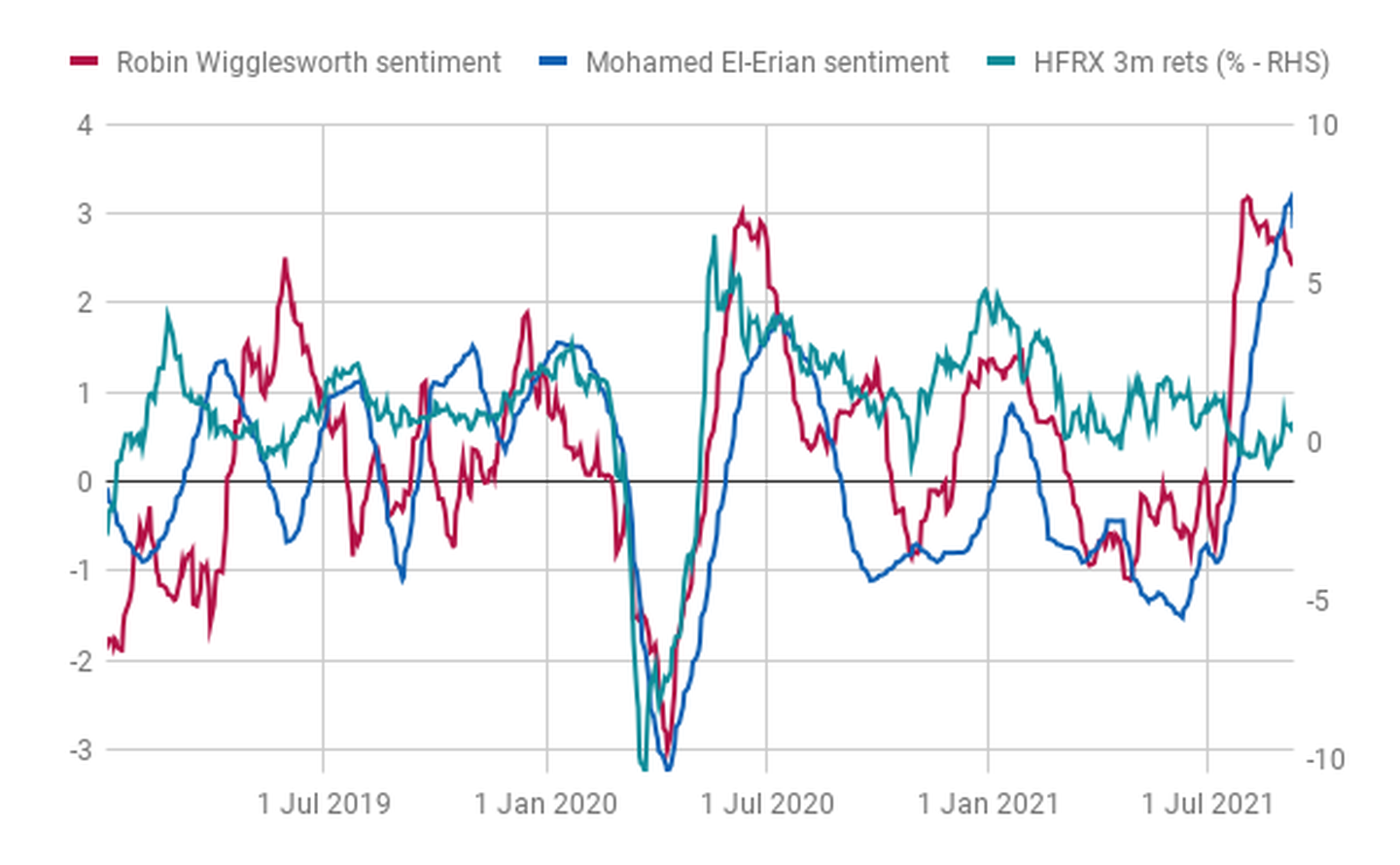

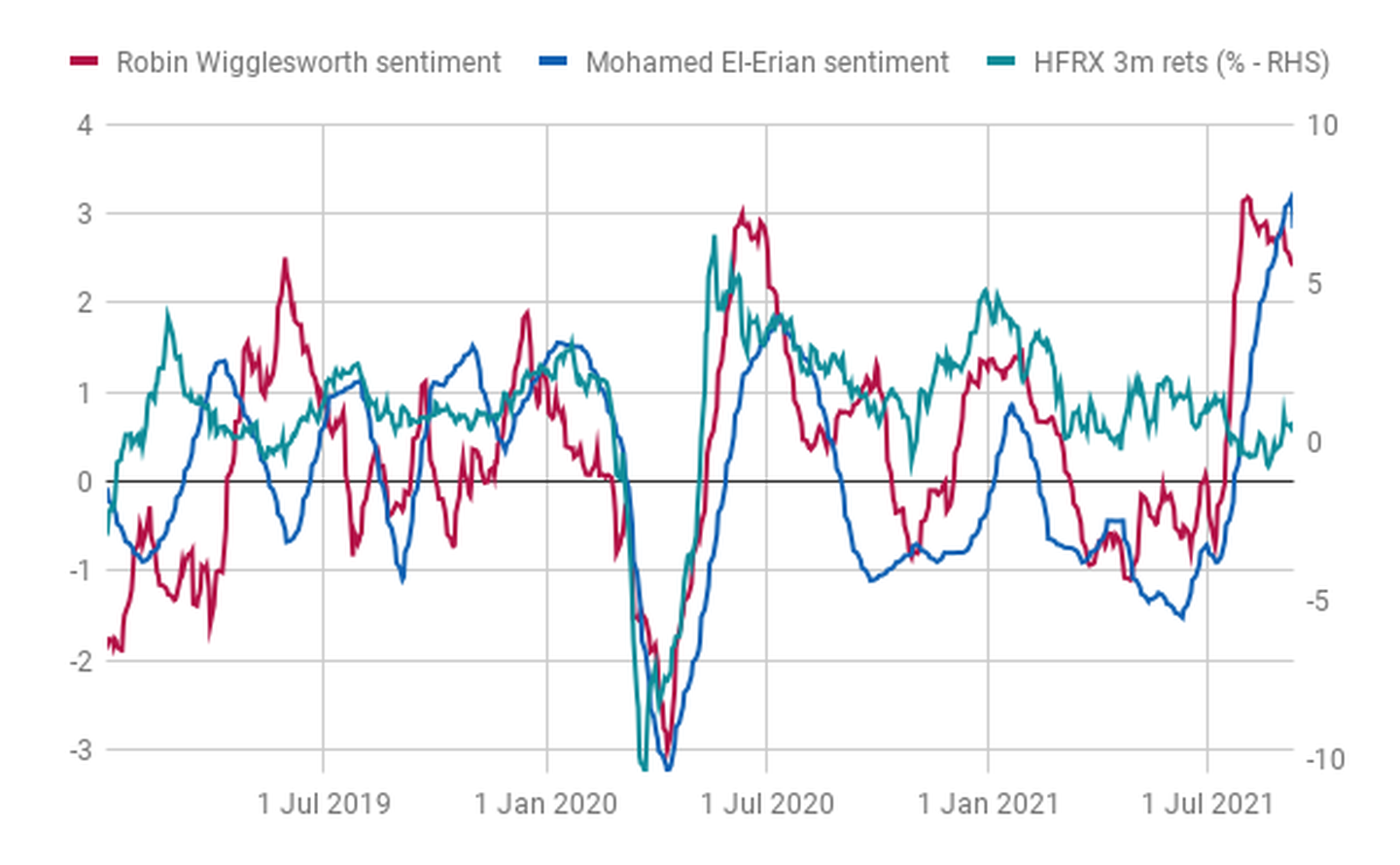

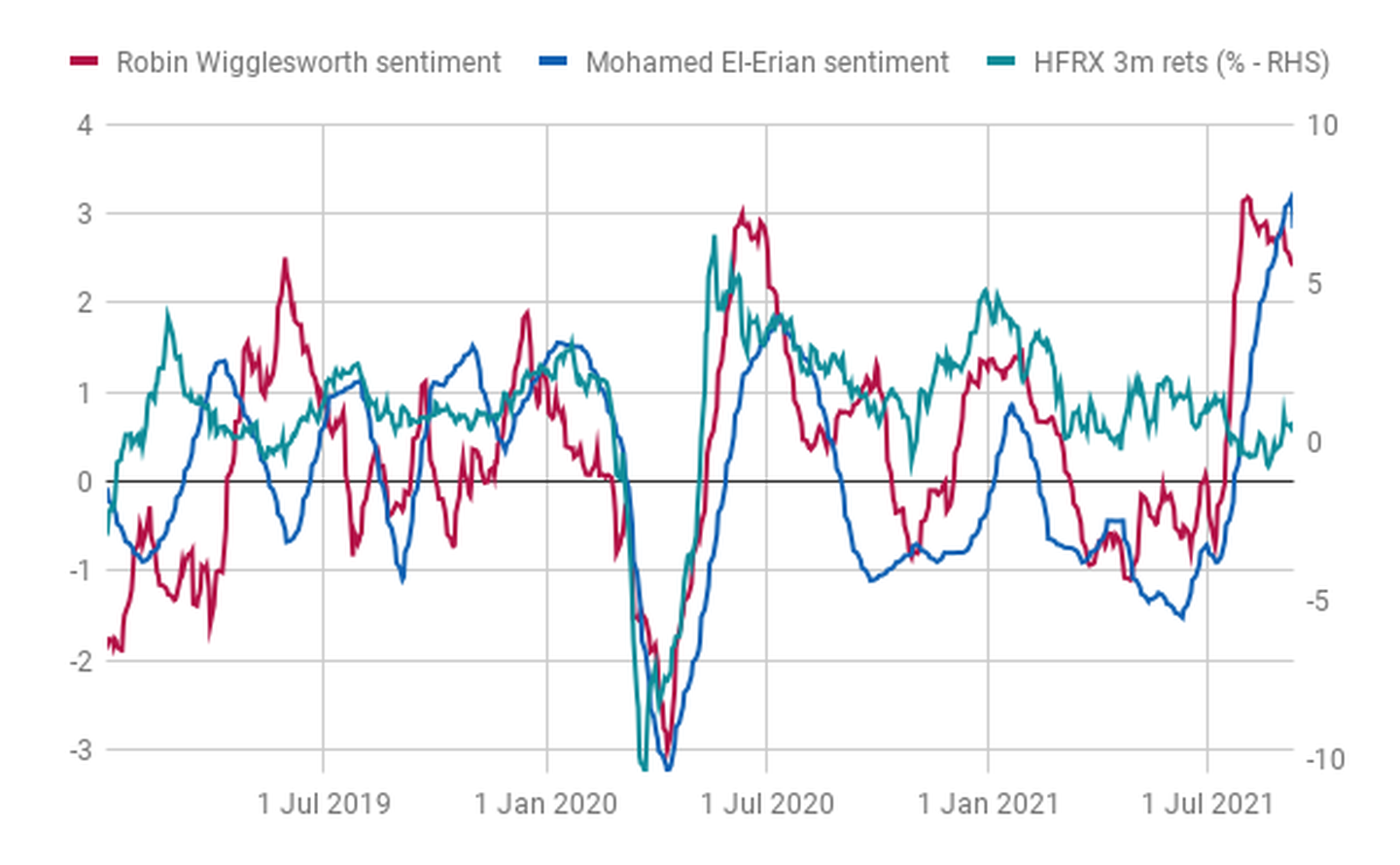

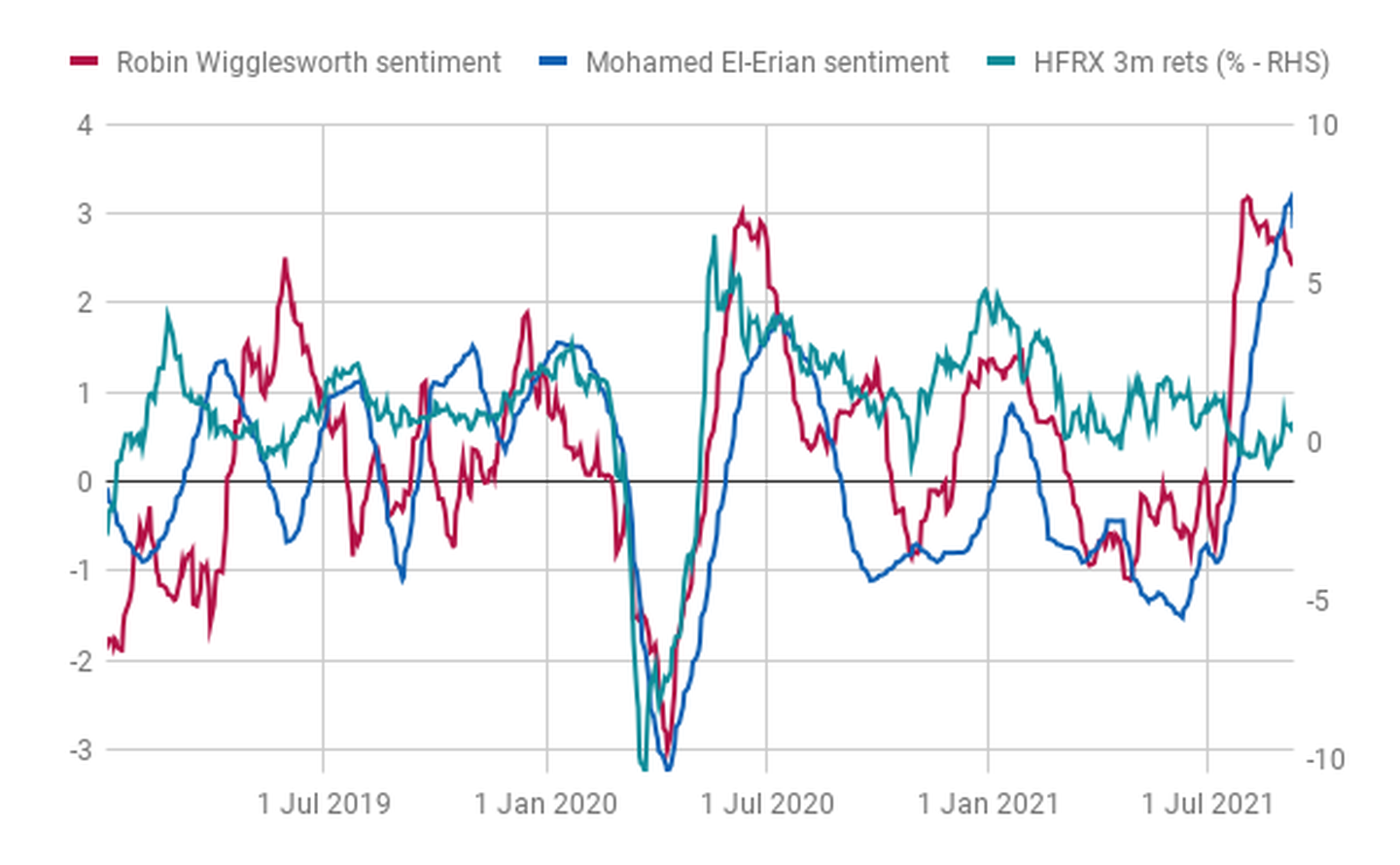

In one example we looked at the sentiment of articles written by regular contributors to the FT, Robin Wigglesworth and Mohamed El-Erian. We created sentiment indices based on the text of their articles. Higher scores would be indicative of more positive language, whilst more negative scores would be indicative of a more pessimistic tone. Below we have plotted these sentiment indices against recent hedge fund returns. Interestingly, we note that the sentiment of their articles broadly tracks that of hedge fund returns in the recent past, in particular during the coronavirus sell off in spring 2021.

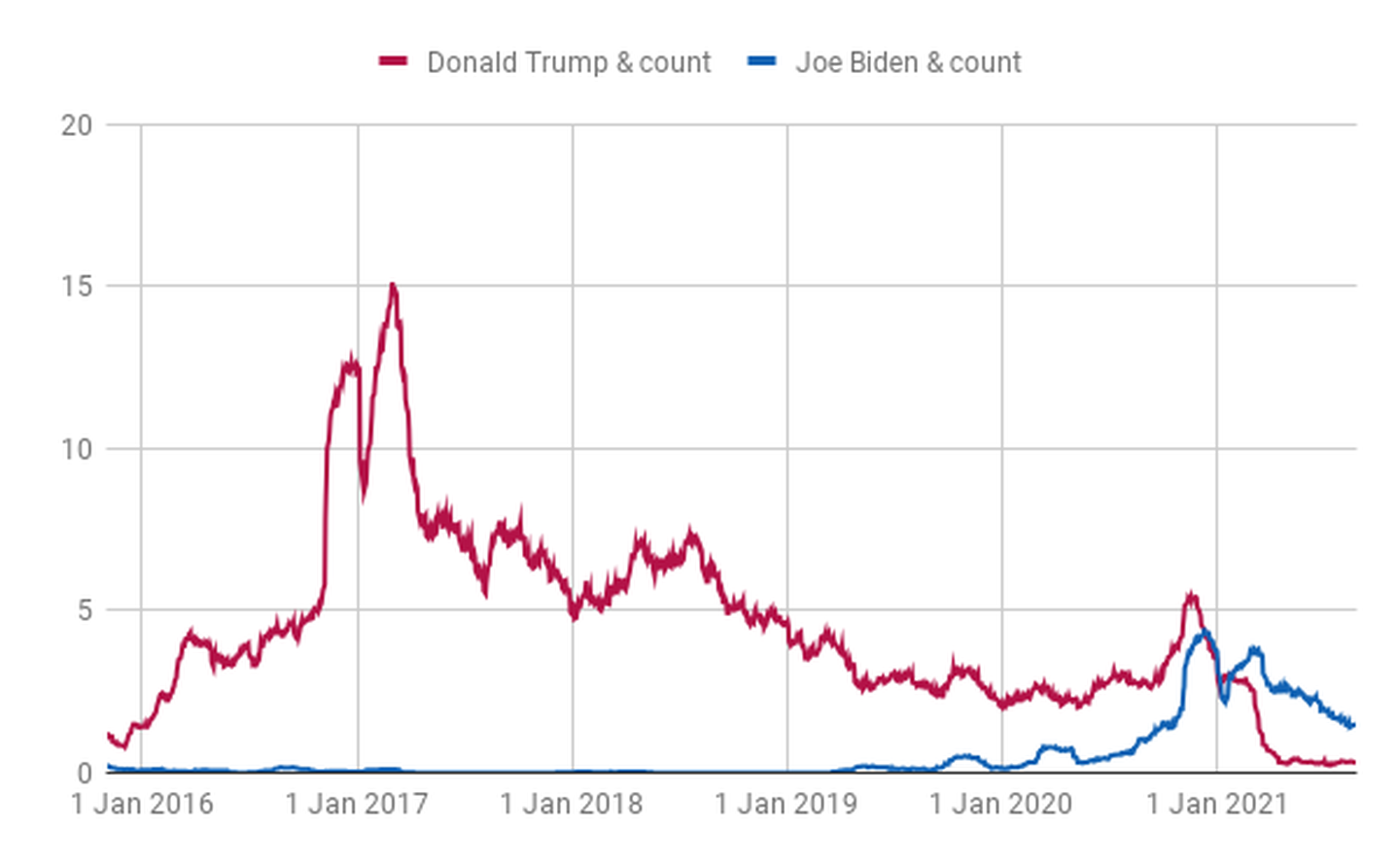

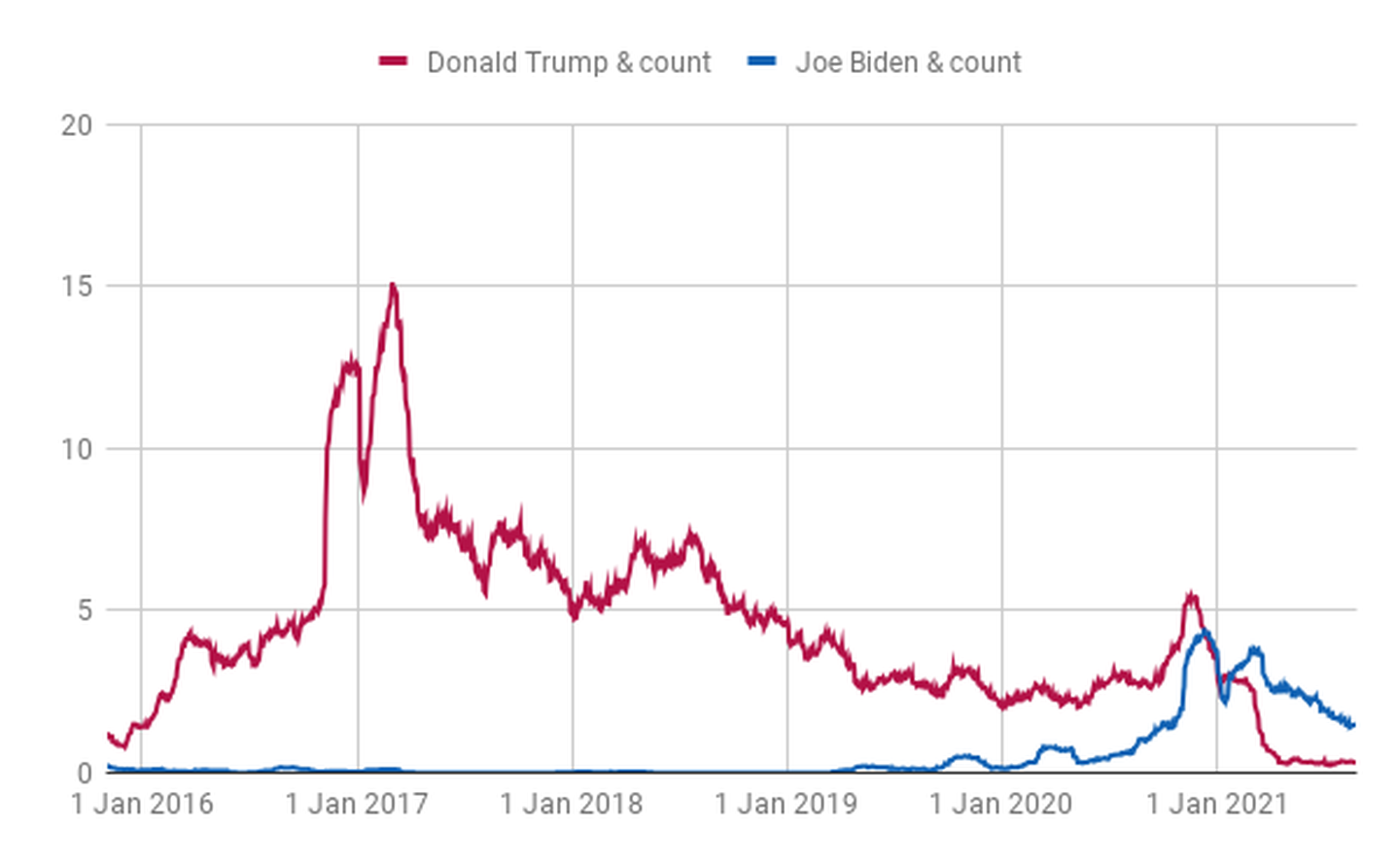

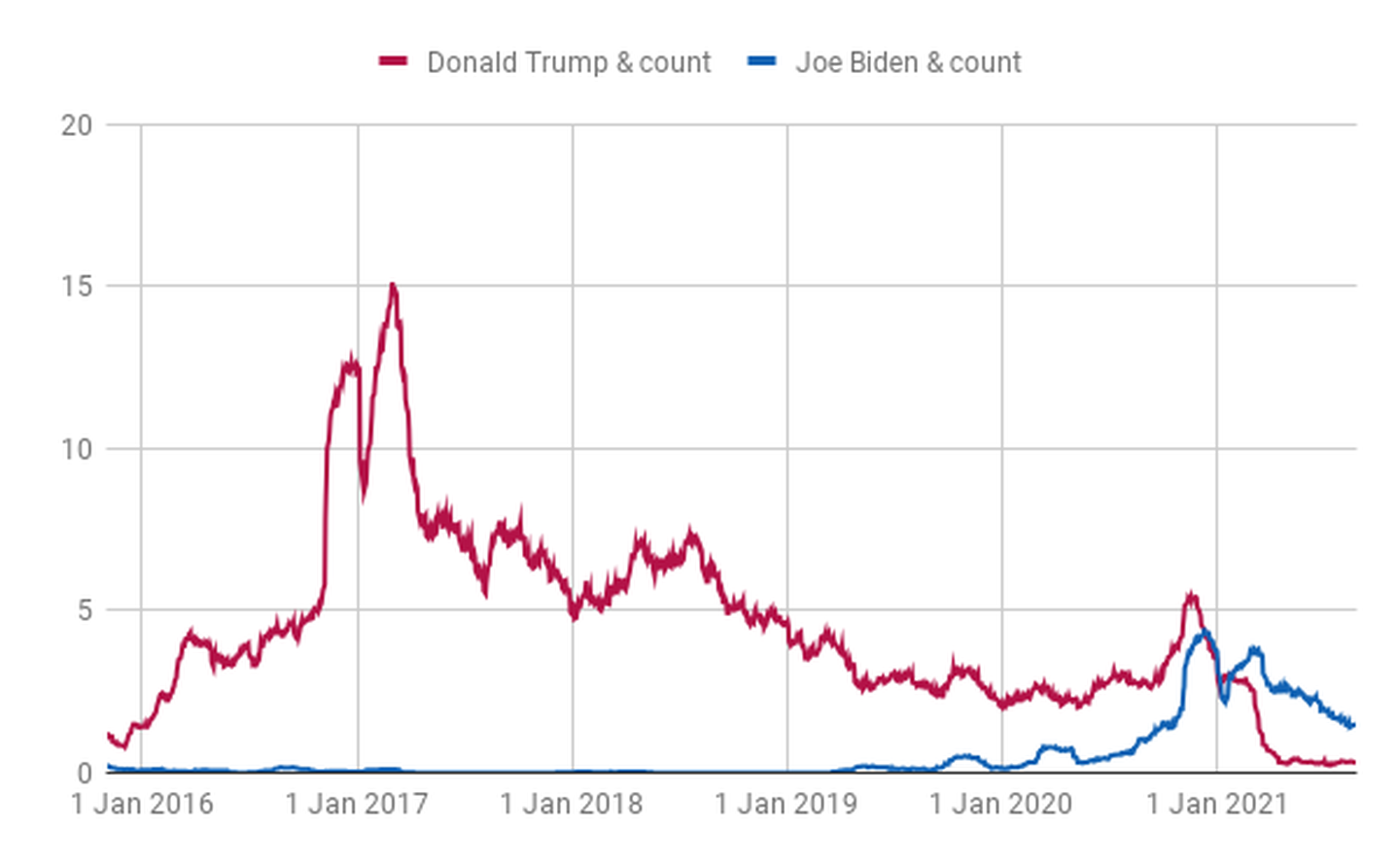

We also have an example of how news counts can give us an indication of shifting narratives. We created smoothed news counts for FT news stories about Donald Trump and Joe Biden, and have plotted these below. Higher scores are indicative of more articles written in the FT, whilst conversely lower scores indicate fewer FT articles about a certain subject. As we might expect, news about Donald Trump declined quickly after he left office. However, the number of articles written about Joe Biden were higher than those of Trump over the same period.

Want to learn more about using machine-readable FT news?

Click below to view the full paper on using FT news to analyse financial markets from the perspective of macro investors.