The relationships between FT journalists and senior leaders across business, finance and politics are continually yielding novel information which presents unique trading opportunities. These ‘scoops’, as they’re known, are often part of bigger storylines and can be indicators of which stocks are subject to the most market hype and therefore are most volatile in terms of price and trading volume.

In this post we explain how scoops can help you determine which types of FT articles are most tradable and suggest ways to monetise this information using FT article metadata, which is only obtainable via the FT content API.

Identifying frequently scooped organisations

FT scoops have the propensity to cause significant market jumps, but they’re very rarely completely isolated occurrences without any form of build up or consequential impact. The FT calling card helps journalists build relationships with key contacts in organisations around the world, and enables them to glean valuable insights for subscribers.

A look at the FT’s article metadata reveals some interesting patterns in terms of the organisations and topics that FT journalists tend to scoop the most stories on. The technology space is an increasingly important pillar of the FT’s reporting, and with a growing team of experts on the ground from Silicon Valley to Shanghai, subscribers get regular insider perspectives from not just the world’s biggest and fastest-growing tech companies, but also the bodies seeking to regulate them more firmly.

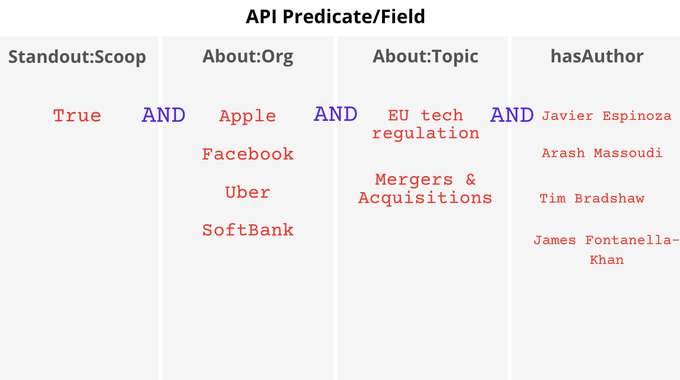

The FT’s top 10 most scooped organisations since 2016 includes 4 technology groups including Apple, Facebook, Uber, as well as the now insolvent Wirecard. With the scale of its investment in all manner of startups and tech firms, you could also place SoftBank alongside this group.

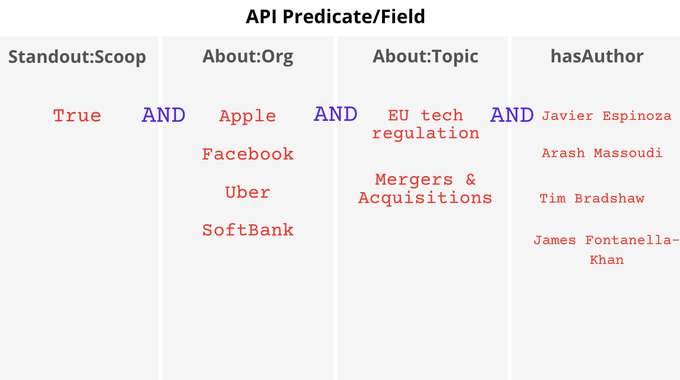

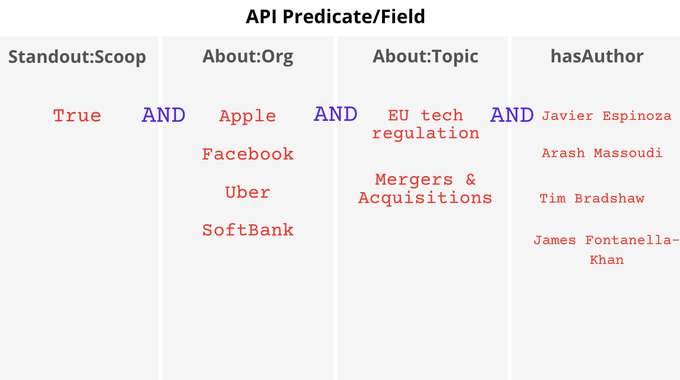

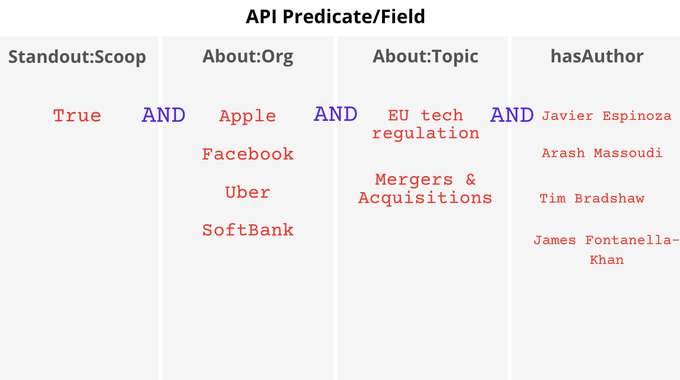

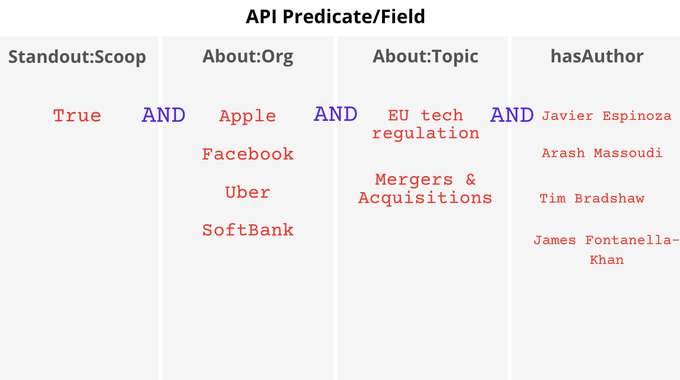

The FT’s network of over 600 journalists around the world lends itself well to encouraging collaboration and knowledge-sharing across desks. Tim Bradshaw has led the FT’s reporting on the likes of Apple and Uber for over 15 years, while James Fontanella-Khan, Arash Massoudi, and Javier Espinoza were part of the group of reporters who founded the FT’s market-leading Due Diligence briefing on all things corporate finance. By combining their access in Brussels, on the US west coast and even further afield, these reporters have the ability to surface the big stories on tech regulation and the EU before other media outlets.

How to use FT article metadata to identify potentially market-moving content

The FT’s Runaway Markets series earlier in 2021 analysed the fervour among retail investors that sent the prices of several unfashionable stocks through the roof. While valuation metrics remain the key component of fundamental analysis, the impact of sentiment and resultant market ‘hype’ on prices offers huge opportunities for those who are able to exploit it earliest.

As a first step, add the FT’s frequently scooped organisations to your watchlists in anticipation of future high-impact events.

Secondly, direct models to listen for the following metadata fields, which indicate that a story has a higher propensity to move the market:

Lastly, compare the average end of day price change for companies in your investment universe on days where the FT publishes a scoop ‘about’ that company, over various time periods. Use insights derived from this historical analysis to forecast the impact of future scoops on price movements.

The power of machine-readable FT journalism

The full value of FT journalism can now be extracted thanks to a datamining licence from FT Integrated Solutions. For those who need to identify these events with the lowest possible latency, we have a NotificationsPushAPI service to cater to these requirements.

The FT’s dataset contains over 10 million metadata annotations across hundreds of thousands of articles. This includes 12,000+ public companies annotated with Financial Instrument Global Identifiers (FIGI codes) for ease of mapping to assets in a portfolio or other stocks of interest.

FT content is not available in this format from any other third party API providers. For more information about how your organisation can leverage Financial Times journalism for smarter investment decision making, please get in touch with the FT Integrated Solutions team.