On February 24 Russia invaded Ukraine, intending to overthrow Kyiv’s government. The west was outraged. The US, UK and EU imposed sanctions with the aim of crippling Russia’s economy. The world’s biggest brands – among them McDonald’s, Coca-Cola, and BP, icons of the post-Soviet era – jettisoned three decades of investment and withdrew from the market.

Writedowns ran into billions of dollars. Corporate reputations nurtured over decades were destroyed in days. It was especially striking that pressure to withdraw came not from the difficulty of operating in the host market but from home-country governments and their activist consumers. Directors of international companies who thought they had mastered geopolitical risk were in shock.

Boards have always faced such threats. To identify a high-risk event takes more than a cursory reading of the newspapers, and even expert analysis can fail to pinpoint how such events can affect a company. This is because everyone views risk through a unique lens.

The potential for harm will depend on factors that range from long-term strategy and geographic reach to government relations and operational exposure.

A single event might spell trouble for one company or division while providing opportunities for another. Just as important will be the resources and experience that a company can draw on.

Each companies’ appetite for risk will be different too. Some will have cultures where they feel at home in risky markets while others will guard their reputation at all costs. Every chief executive and board has to determine their company’s specific risk profile and its response to any threat.

So how should directors view political risk? No matter how tightly a company controls its operations or minimises danger, threats can emerge unexpectedly. As events in eastern Europe show, these can be hard to foresee and remedy.

Directors can start by distinguishing between events that can be anticipated and mitigated, such as labour conflicts or regulatory change, and unexpected developments like coups d’état, runs on banks or devaluations.

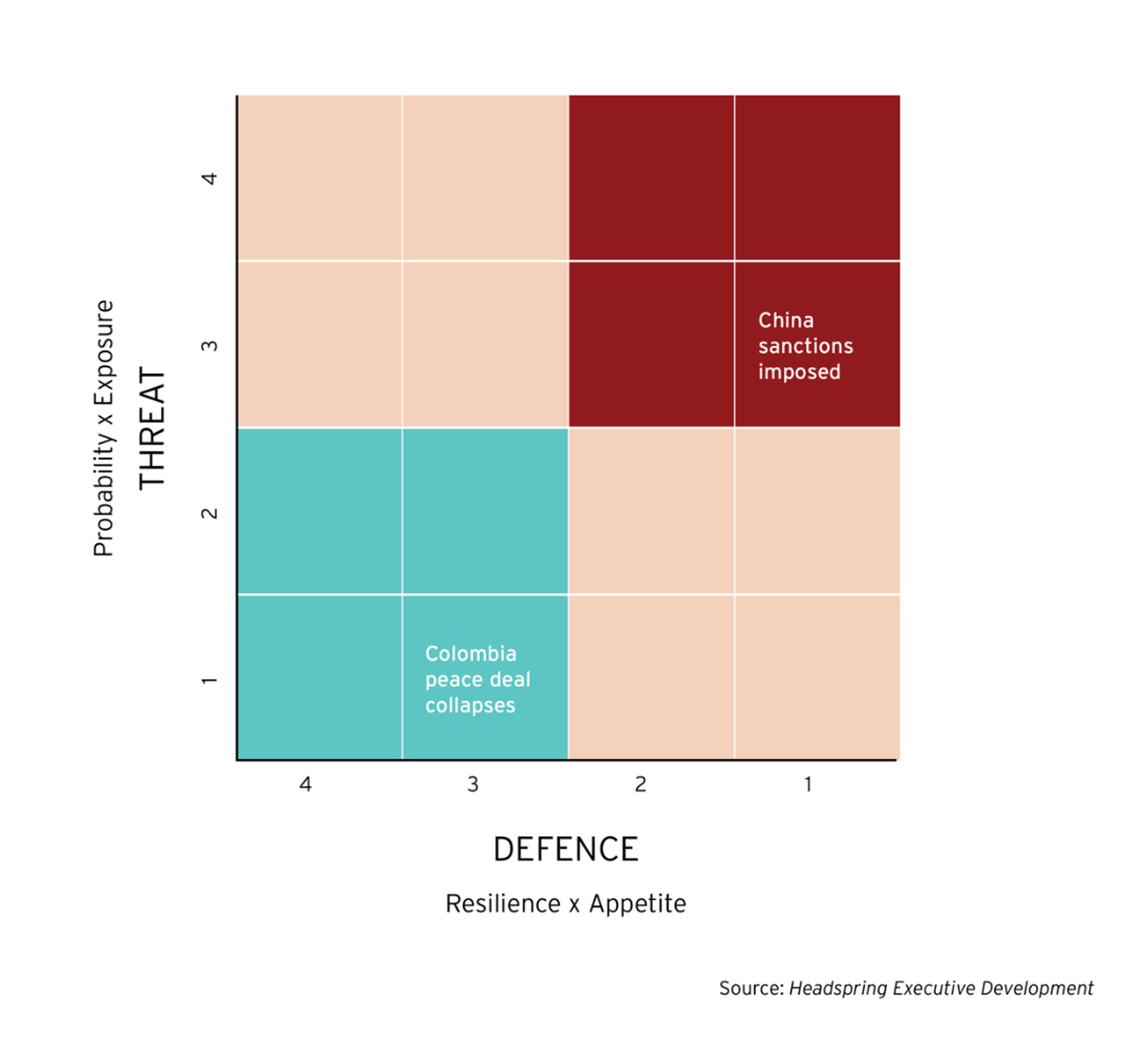

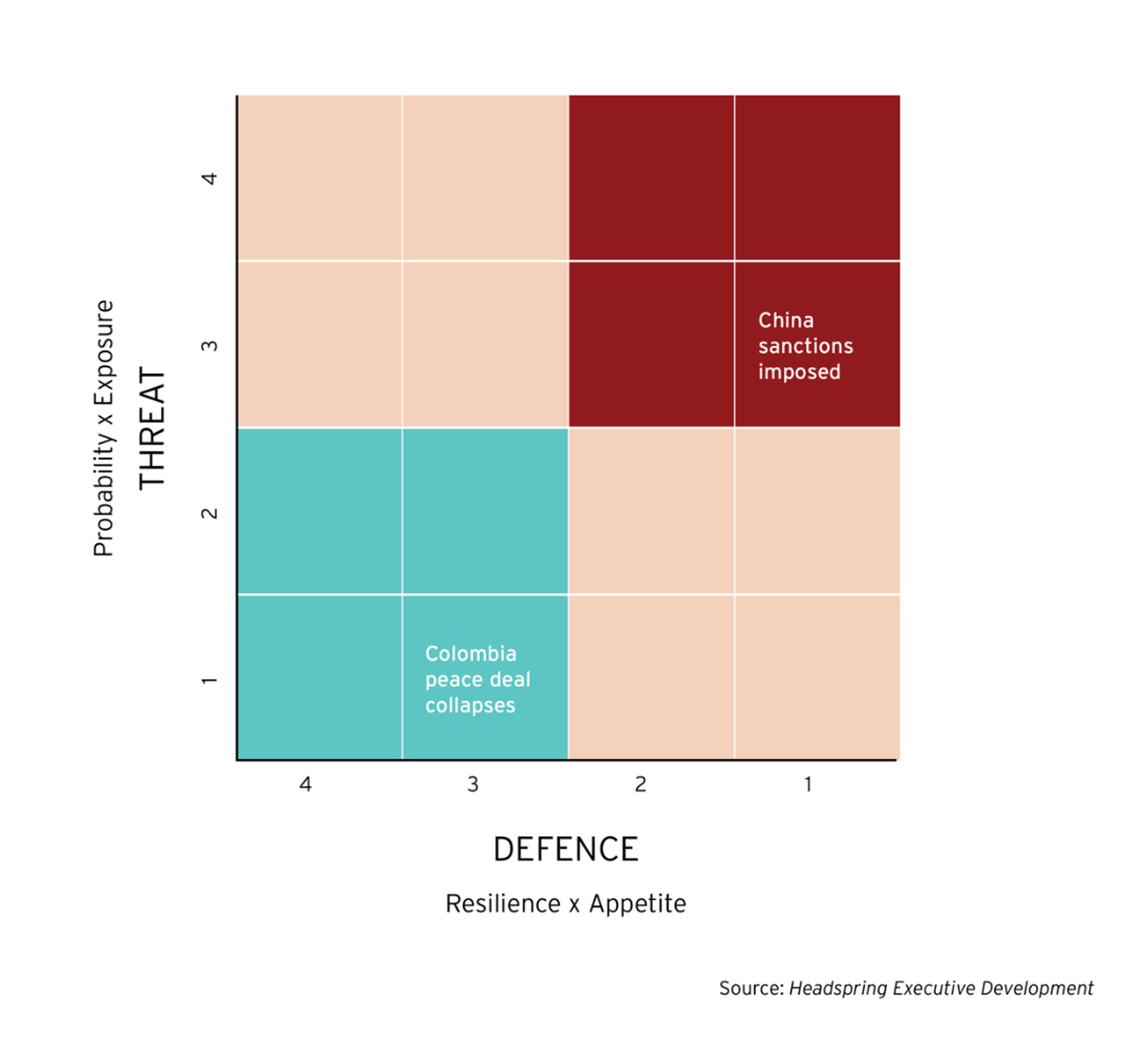

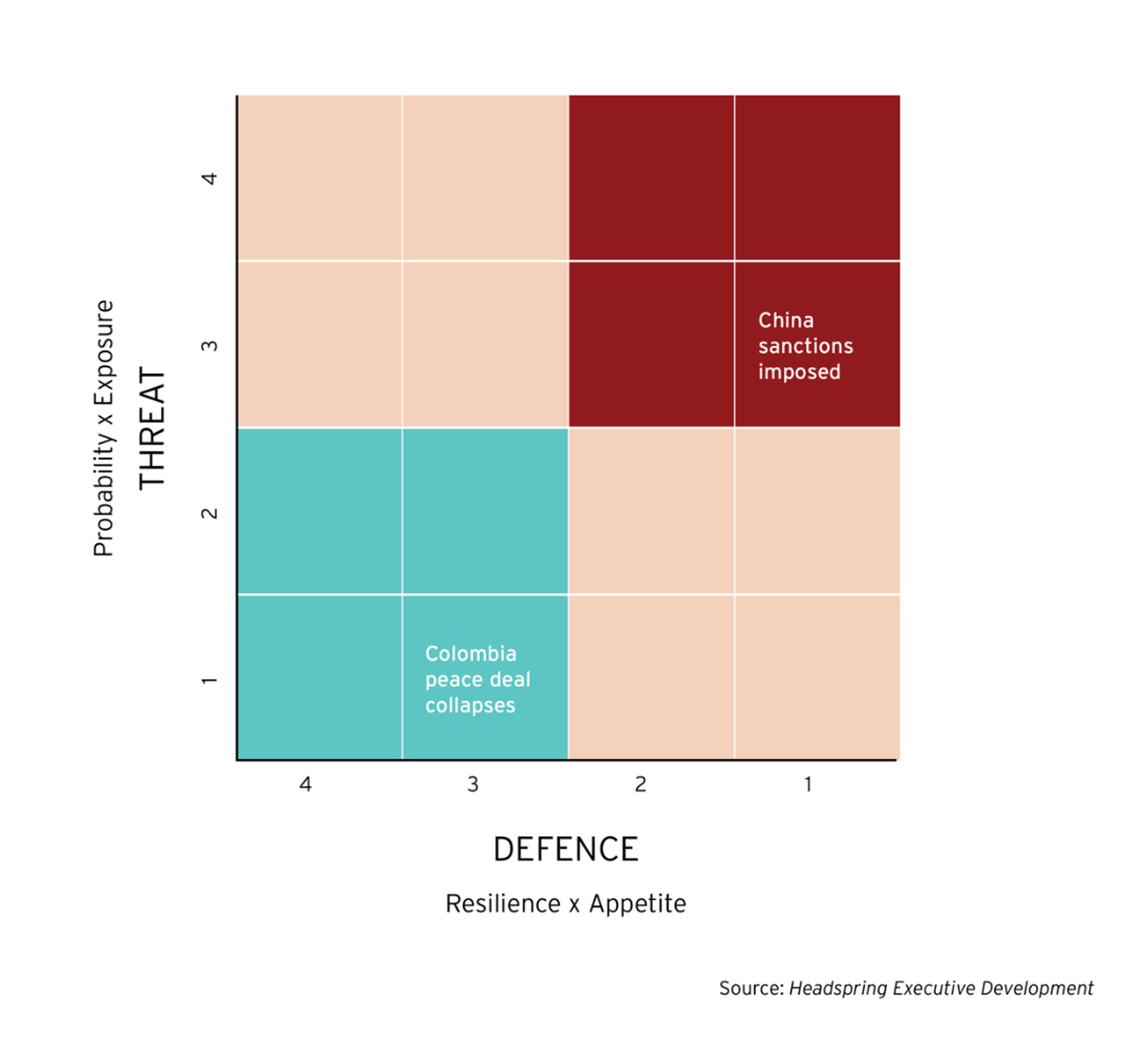

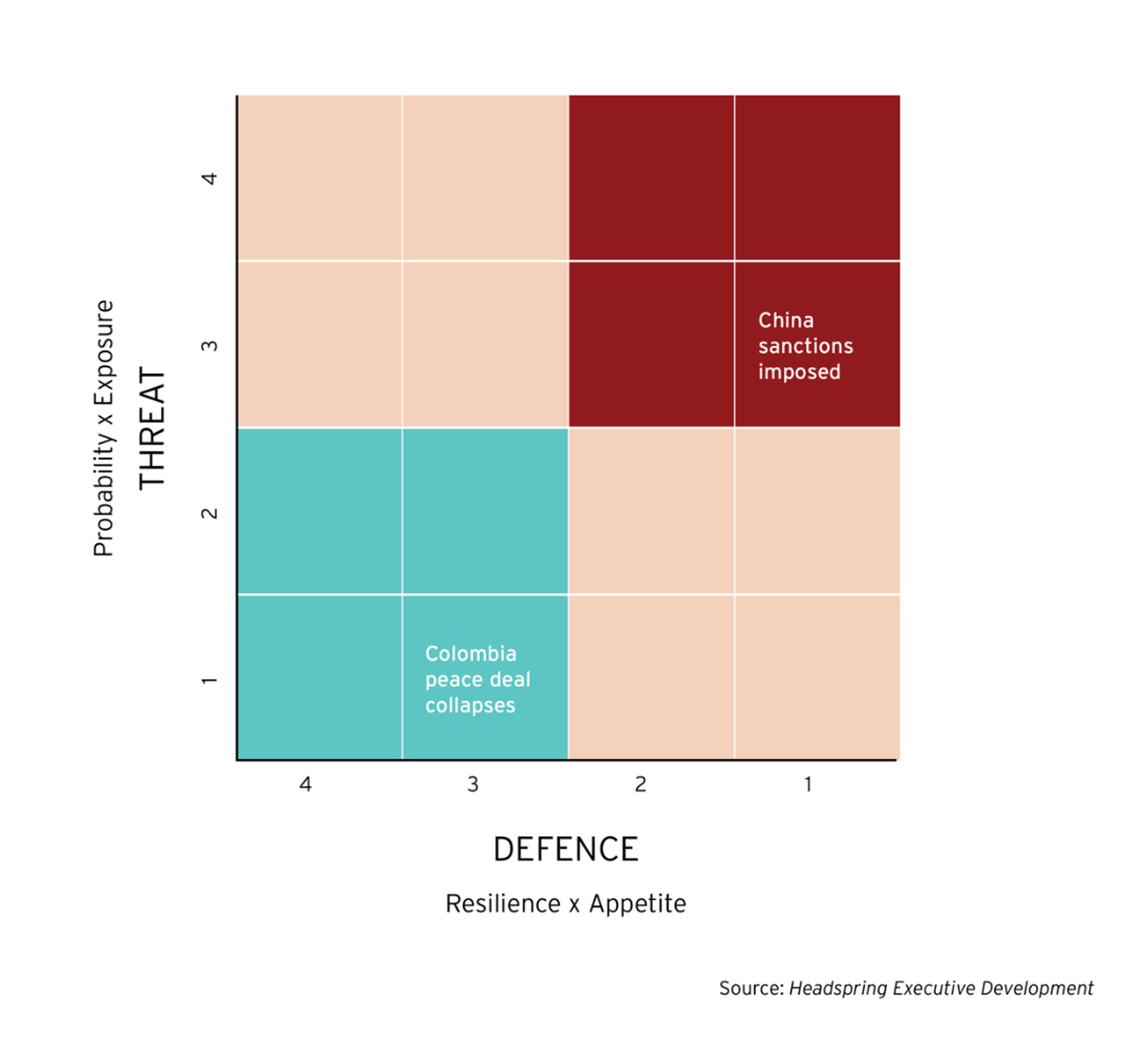

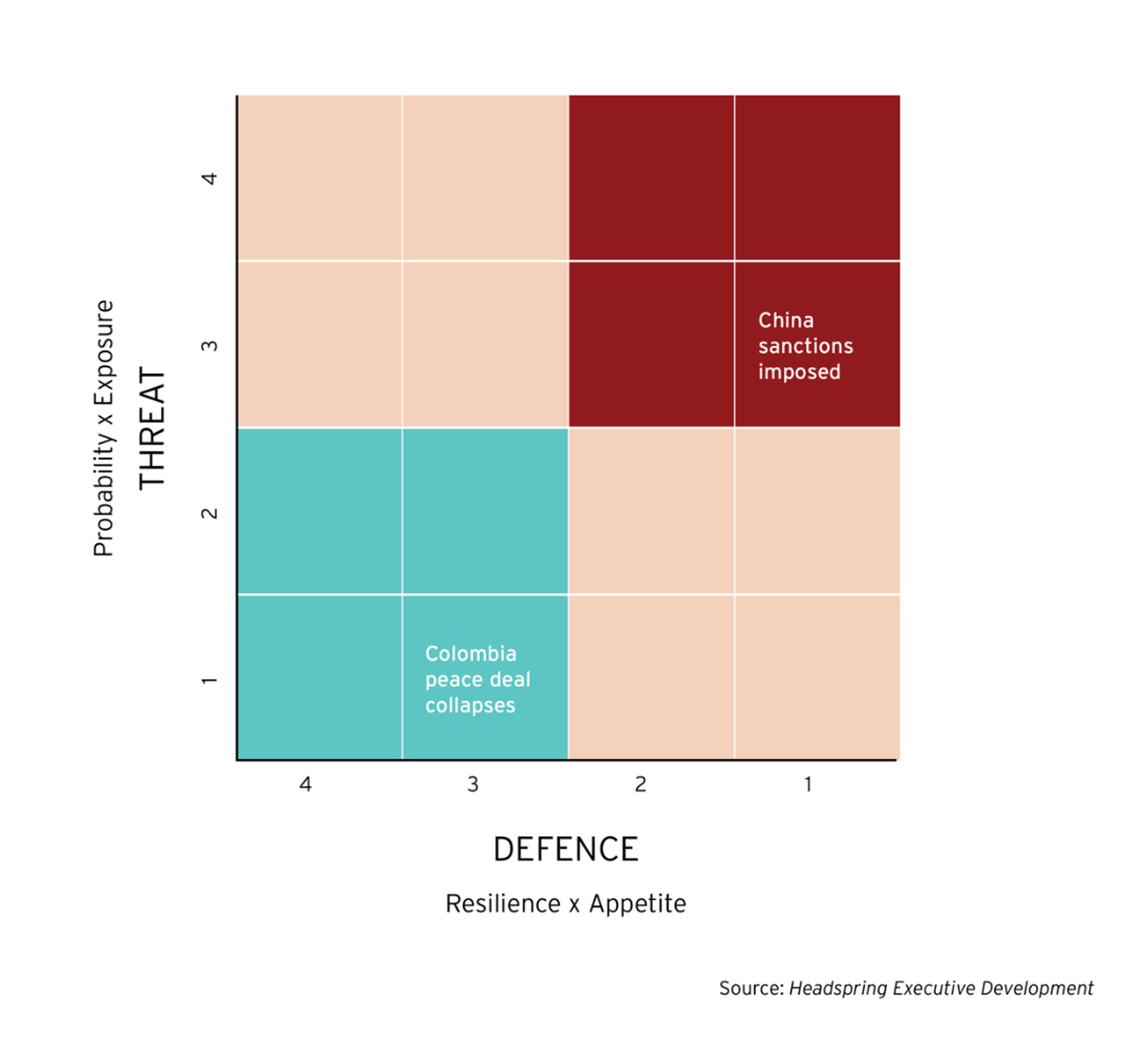

A systematic approach allows companies to envisage many risks, understand how they affect their interests and thus their importance to the company, and then plan remedies.

A simple framework of five actions can help leaders to anticipate geopolitical risk:

• Scan the horizon. What is the range of risk events and their probability of occurring? General Motors, the US automaker, has 400 partners in its supply chain, factories in 20 countries and consumers in every market. Disruption in any one place could dent sales and profits much farther afield. Companies with exposure across multiple markets will need specialist teams to gather and interpret intelligence, whether this is about local politics, security, laws and regulations or anything to do with adverse political dynamics.

Action point. List the top 10 or more risks and rank them according to their likelihood of occurring

• Calculate exposure. Work out how much the company has at stake for each risk. Even where the likelihood and timing of a risk event is clear, exposure will differ. For example, GM sources seats from Lear Corporation, spending $250bn a year; a failure there would be costlier than one at Remy International, from which it buys electronic equipment, spending a tenth of the amount. Exposures to consider can include falling revenues, lost production days, supply chain disruption or reputational damage.

Action point: Add to the above risk list a commentary around how each risk might limit operations, ranking the potential effects

• Determine your risk appetite. How much risk is the company willing to take? This will depend on several factors. Well-funded start-ups in fast-growing industries may be hungry for risk; less so for established companies operating on narrow margins in heavily regulated industries. The recent experience with Russia might have altered the view about which risks are tolerable. Ultimately, willingness to accept a risk depends on a trade-off between potential cost and reward.

Action point: Determine your risk appetite for dealing with the effect of each risk. If plausible provide a cost-benefit calculation

• Assess your resilience. How prepared is the company to confront the risk? What mechanisms/skills/hedges are in place already? Resilience is a function of how well a company has performed the above three steps and its readiness to respond.

Building resilience – a company’s armour – is the purpose of risk management. It relies on making well-informed, timely decisions about where and how to set up operations, and deploying people and resources to address threats and exploit opportunities. For example, Royal Dutch Shell protects itself from some protests by liaising with Greenpeace, the environmental group.

Action point: Use a rating to assess resilience for each weak point in your operations

• Respond. Each threat should prompt one of three responses. First, accept it. If it is unlikely to occur and its effect on the business would be modest, one might choose to deal with any consequences as they arise. Second, transfer the risk. Insurance and hedging instruments are available. Third, increase preparedness and resilience. Hiring extra expertise or investing in otherwise redundant systems might make a risk more tolerable.

Action point: Draw up a company-specific set of scenarios, vulnerabilities and actions to guide leaders when a crisis hits

Drawing these variables into a framework provides the board with a company-wide view of where its geopolitical risks lie, so helping them to allocate resources, assign responsibilities and, ultimately, seize business opportunities.

Founded on the principle that executive development needs to be collaborative, relevant and measurable, Headspring Executive Development’s purpose has been to design a new approach that is fit for the challenges and business environment of the 21st century. They combine the business acumen, academic rigour and innovative approach of IE Business School with the perspectives and skills of the most influential Financial Times journalists.

This guide has been brought to you by FT Board Director. If you are not a member, register here.